Time Deposit Account

Posted : admin On 4/2/2022Visit the “Manage Funds” tab within Financial Manager to replenish your deposit account using a one-time electronic funds transfer (EFT) or deposit account transfer. Online replenishments should update your deposit account balance within 15 minutes (it may take longer to appear on Financial Manager reports) and will then be immediately. A time deposit, also referred to as term deposit, is an interest-bearing bank account with a fixed term. It allows depositors to grow their money with higher interest rates compared to a regular. How much time will it take for my deposit to reflect in WazirX? UPI Deposits - Your account will be credited within 15 mins if the UPI status is successful IMPS/NEFT/RTGS - At the moment, you should consider 24 working hours as the maximum time it will take for IMPS/NEFT/RTGS deposits to reflect. The BANK may close an account any time without prior notice to the Depositor, if the deposit balance becomes zero, due to collection of service charges by the BANK or withdrawal by the Depositor, or for violation of existing rules and regulations of the BANK, the Bangko Sentral ng Pilipinas, Anti-Money Laundering Council, Bankers' Association.

That is the growth you would want to expect from your time deposit.

Time deposit (TD) is a type of savings account that earns a fixed interest rate upon reaching maturity. Funds in a time deposit cannot be withdrawn during the term of the maturity but can be pre-terminated subject to penalty fees.

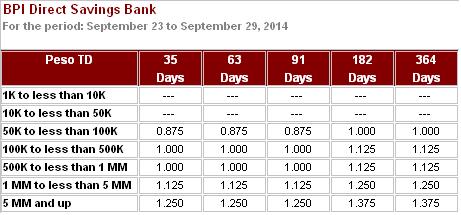

The interest rate in time deposit differs from bank to bank but normally plays between 1.5% and 3% with the latter given to longer term time deposit.

Tenure

The tenure for time deposits usually range from 1 month to 5 years with time deposits with maturity terms below 1 year considered as short term and any deposit with a maturity term exceeding 1 year are long term deposits. Philippine banks normally offers 1%-1.5% for short term TD and up to 3% for long term TDs.

Pre-terminating your Time Deposit

Most time deposits pay out the earned interest only at the end of the term, although some Philippine banks allow you to be paid interest every month in the case of long term deposits. This means, if you chose a one year term deposit, you will earn the entire interest rate as indicated in the agreement you signed at the end of 1 year, provided the principal amount was not withdrawn.

In the event of early withdrawal, the interest is usually forfeited. In other cases, a penalty fee is applied to the depositor, usually equal to up to 75% off of the accrued interest rate from the date of the account creation up to the date of the pre-termination.

If you want to find the best time deposit for your needs, you should check our time deposit comparison table.

Time Deposit Account Interest Rates

Related Articles:

Time Deposit Account Types