Td Bank Cd Rates

Posted : admin On 4/7/2022Find a TD Bank near you Open Early, Open Late Not sure which small business CDs are right for you? Read more about the benefits and features of each to help you decide.

You might also be interested in: |

Td Bank Cd Rates Special Promotion

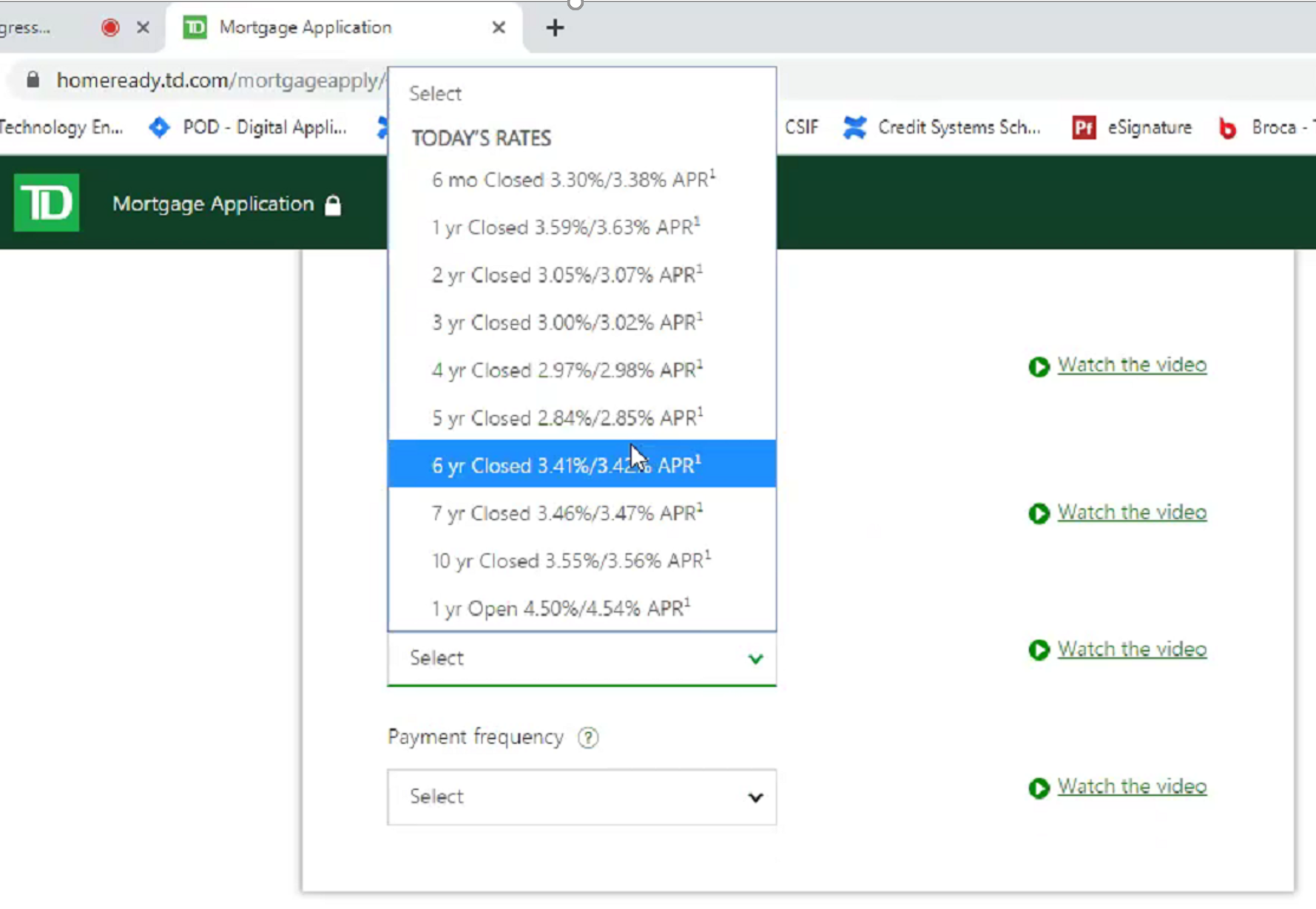

Bank CD rates compare to top-yielding banks. Compared to other banks, U.S. Bank’s CD rates leave a lot to be desired. You can currently find competitors paying around 0.65 percent APY. Posted rates on this page are subject to change at any time without notice. 1 Partial and full withdrawals may be made without penalty during a ten (10) day grace period that begins on each anniversary of the account opening date. 2 For the TD Step Rate CD. Regular CDs and Rates: Axos Bank offers seven CD options with good rates: 3-month, 6-month, 12-month, 24-month, 36-month, 48-month, and 60-month. Yields apply on all balances above the $1,000 minimum deposit amount and currently sit at 0.20% APY for all products. TD Bank 12 Month CD Rates. 7 Year Interest Rate was based on the basic cd rates product.