Chime Mobile Check Deposit Time

Posted : admin On 3/15/2022Get paid up to 2 days early with direct deposit.¹ Say goodbye to hidden bank fees². Grow your savings, automatically.

- How Long Does It Take For Chime Mobile Check Deposit

- Chime Mobile Check Deposit Time Card

- Chime Mobile Check Deposit Timeline

- Chime Mobile Check Deposit Cutoff Time

You can also have a direct deposit enrollment form emailed to you from the Move Money section of the Chime app. We will only post deposits that are sent under your name. All others will be returned to the sender. Early direct deposit may provide you with access to your paycheck up to two days early. Chime offers mobile and online banking through its banking partners with no hidden fees‡. Overdraft up to $100. with no fees, get paid up to 2 days early with direct deposit^, and grow your savings instantly with purchase round ups and an optional High Yield Savings Account (get up to 0.50% Annual Percentage Yield‣ ). Save, spend, and manage your finances with the highly rated Chime mobile.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Frequently Asked Questions

The Basics

At Chime, we’ve created a new approach to online banking that doesn’t rely on fees, gets you your paycheck up to 2 days early with direct deposit,¹ and helps you grow your savings automatically. When you open a bank account through Chime, you get a Visa Debit Card® and a Spending Account that can be managed entirely from your smartphone, plus an optional Savings Account that helps you grow your savings automatically! The Chime mobile banking app is available on both Android and iOS.

Chime is a financial technology company. Banking services provided by The Bancorp Bank or Stride Bank, N.A.; Members FDIC.

Our mission is to make financial peace of mind a reality for everyone. We’re doing that by changing the way people feel about banking. Chime’s business was built on the principle of protecting our members and making managing your money easy. We’ll never profit from your misfortune or mistakes and everything we build is focused on improving our member’s lives.

Unlike traditional banks that may charge consumers fees left, right, and center, Chime makes money from “interchange.” Every time you use your Chime Debit Card, Visa processes the transaction and charges an interchange fee for the service. We get a percentage of that interchange fee every time you use your Chime Debit Card, which means we never have to charge you those unnecessary fees to run our business. It’s a win-win for everyone!

U.S. Citizens 18 years and older are welcome to apply! While Chime cards work all over the world, currently we can only offer accounts to members with a valid SSN, living in the United States and District of Columbia.

We don’t believe in unnecessary fees or profiting from our members’ misfortune. We have no fees to sign up, no overdraft, no monthly or service fees, no minimum balance fees, no transaction fees, and no card replacement fees either. We do charge one fee ($2.50) when you get cash from either an over the counter withdrawal, or an out-of-network ATM that is not part of Chime’s fee-free network of 38,000+ ATMs.

Please note that third-party money transfer services used to deposit or withdraw funds to your Chime Spending Account may impose their own fees per transaction.

Yes! Chime’s SpotMe feature lets you make debit card purchases that overdraw your account with no overdraft fees. Limits start at $20 and can be increased up to $100.³ We’ll spot you when you need that little extra cushion to cover an expense. Learn more here!

When you open a Chime Spending Account you get a Chime Debit Card that can be used at any merchant that accepts Visa. Your Chime Debit Card can also be used with mobile-payment providers such as Apple PayTM, Google PayTM or Samsung PayTM. Other features our members love about our Chime Visa Debit Card are instant transaction notifications anytime your card is swiped, the ability to instantly block your card and order a replacement Debit Card all from within the Chime mobile app.

The Chime Credit Builder Visa® Credit Card is our no fee, no interest, secured credit card that helps you build your credit. Unlike traditional credit cards, Credit Builder helps you build credit with no fees and no interest. There’s also no credit check to apply. The money you move into Credit Builder’s secured account is the amount you can spend on the card. Unlike other secured credit cards, that money can be used to pay off your monthly balances. Since Credit Builder doesn’t have a pre-set limit, spending up to the amount you added won’t contribute to a high-utilization record on your credit history. Learn more about how Credit Builder works.

When do I receive my Chime Visa Debit Card after I open a Chime Spending Account?

After you open a Spending Account, we get started on personalizing your new Chime Visa Debit Card. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Spending Account. It can take 5 to 10 business days for your Chime Visa Debit Card to arrive at your home address.

If you don’t have your Chime Visa Debit Card within 10 business days after opening your Spending Account, please contact our Member Services team at: support@chime.com

Getting Started

Direct deposit is the easiest way to add funds to your account. Enrolling in direct deposit with Chime has an added benefit too: you are automatically eligible to receive your paycheck up to 2 days early!**

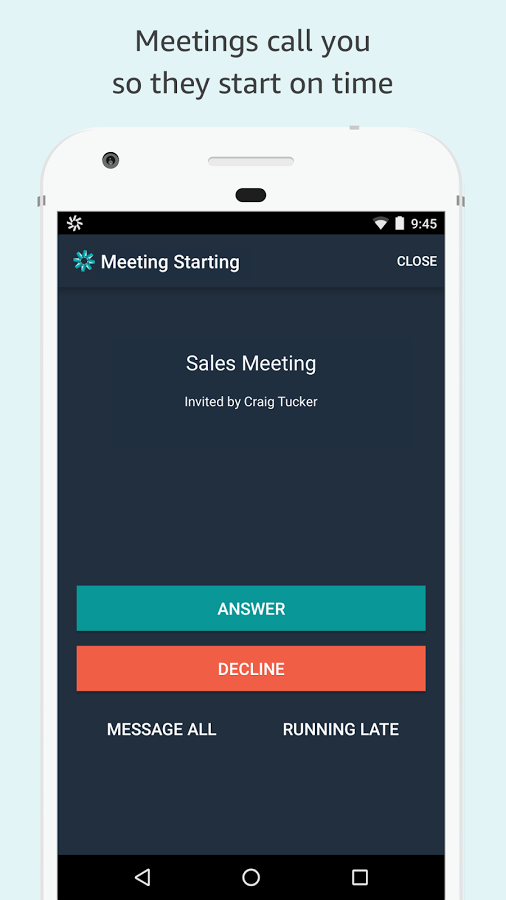

We also support mobile check deposit and electronic transfers from other institutions by linking an external bank account and in the Chime mobile app.

Cash deposits can also be made to your Chime Account at over 90,000 retail locations such as Walgreens, CVS and 7-Eleven using the Green Dot® Network.

You can use our Pay Friends feature to send money to Chime members instantly, and free! To use the Pay Friends feature, simply log into your Chime mobile app and select the ‘Move Money’ tab, then select ‘Pay Friends’. You will then be prompted to enter in either the receiver’s name, phone number or email, or you can select them from your contacts.

We have a network of 38,000+ fee-free ATMs for Chime members through MoneyPass® or Visa® Plus Alliance. To find a fee-free ATM near you, download the Chime mobile app and tap on ATM map. You can also search our ATM network.

Although fewer checks are being written these days, we understand that some bills like rent, credit cards, student loans, and other payments sometimes require you to pay with a check.

To assist our members in these situations, we offer the Chime Checkbook feature!

Can I deposit paper checks with Mobile Check Deposit?

Chime will determine if you are eligible for the Mobile Check Deposit feature based on the history of any Chime-branded accounts you have, direct deposit history, and direct deposit amounts and other risk-based factors.

Chime offers mobile check deposit to members who receive payroll direct deposits over $200 a month. Thirty days after you receive your payroll direct deposit, mobile check depositing will be automatically enabled in your Chime app!

How do I pay bills using my Chime Spending Account?

You can set up direct debit payments with billers who offer this option by providing your account and routing number to the merchant.

Direct debits are immediately removed from your Spending Account when requested by a biller and do not place any hold on your funds. If your balance is not sufficient to cover the payment, it will be declined. There are no limits or fees associated with direct debits.

We currently offer a referral bonus every time you refer someone new to Chime using your referral link, and they receive a single qualifying direct deposit of $200 or more! Your friend must enroll and complete a single direct deposit of $200.00 or more from their payroll provider within 45 days of opening their new account. If the terms are complete, both you and your friend will get $50 each! You can find the link for inviting everyone you know in your Chime app!

You can also copy-and-paste your invite link and share on Facebook, Instagram, or Twitter.

Also, keep an eye on Chime on our Instagram, Facebook, Twitter, and Youtube to hear about new offers!

Referral Incentives

Occasionally, we’ll offer incentives to invite your friends to join Chime. We’ll notify you through email or in the Chime mobile app when a referral offer is available.

Our Member Services team is always happy to help! You can reach us 24/7 via the customer support tab in the Chime app, or by email at support@chime.com.

Our phone specialists are available through our customer service number at 844-244-6363. Our hours of operations are:

- Monday-Friday: 6am-10pm CST

- Saturday – Sunday: 7am-9pm CST

Security

Our top priority is protecting our members. We use 128-bit AES encryption, access control, and security processes to ensure your money is always safe with Chime. If you notice an unauthorized transaction, you can disable transactions on your Chime card immediately in the settings section of the Chime app and website to prevent further unauthorized card transactions.

Chime bank accounts are insured up to the standard maximum deposit insurance amount of $250,000 through our partners, The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Can you use your Chime Visa Debit Card in other countries?

You can use your Chime Debit Card anywhere Visa cards are accepted, including outside the U.S. and with no foreign transaction fees! International transactions can be enabled or disabled in the settings menu found in the Chime mobile banking app.

What do I do if I don't recognize a transaction in my Spending or Savings Account?

If you do not recognize a transaction in your Spending or Savings Account,we ask that you temporarily block your card:

- Use the Chime mobile app or by log in to your account at www.chime.com.

- Go to Settings and turn off Chime Card Transactions.

This feature immediately prevents new purchases and ATM transactions on your Chime Visa Debit Card account. - Contact us immediately in one of several ways:

- Call us at 1-844-244-6363

- Use the Chime mobile app to contact our support team

- Email support@chime.com

Chime is a full-featured deposit account. Your account can receive direct deposits and it supports pre-authorized withdrawals and interbank transfers through the Automated Clearing House (ACH) Network.

Chime gives you:

- A Chime Visa® Debit Card

- An FDIC-insured deposit account that can be managed entirely from your smartphone

- An optional Savings Account that helps you save money without thinking about it

Chime bank accounts are insured up to the standard maximum deposit insurance amount of $250,000 through our partners, The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Where can I find more information on your policies?

You can check out our privacy practices, Account Agreement, and all the legal information pertaining to your account here: Privacy Policies

2 minutes with no impact to your credit score.

Learn how we collect and use your information by visiting our Privacy Policy›

Your federal tax refund is important, and we want you to have it as fast as possible. That's why you can get your tax refund up to 3 days early1 when you direct deposit with Chime and file directly with the IRS.

in government payments have been processed by Chime to date.

that filed with the IRS have received their government refunds up to 3 days early1 through direct deposit with Chime.

Filing your taxes can be complicated.

Getting your federal tax refund early1

with Chime is simple!

The IRS will start processing returns on February 12, 2021. Here’s how to help your federal tax refund arrive as quickly as possible with direct deposit.

You may receive forms from your employer or financial institution.

Add your Chime Spending Account and bank routing number when you file your federal taxes directly with the IRS.

Your federal tax refund will post to your Chime Spending Account as soon as it is received.

New to Chime?

Get your federal tax refund up to 3 days early1, access to Chime’s best features, and financial peace of mind by signing up! The process is fast and easy.

We’re going above and beyond to have your back

We can’t control how the IRS processes taxes, but we’re here to help you figure it out and get your refund as fast as possible. Check out our resources on this page for more.

FAQs

If you have questions regarding taxes and your Chime account, please check out our FAQs below

Chime & Taxes

Nope! You do not have to pay or declare taxes for using Credit Builder. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Will I have to pay taxes on SpotMe? Stimulus advances?

Nope! You do not have to pay or declare taxes for using SpotMe or any of the SpotMe Stimulus Payment advances. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

I just got my refund! What are my spending/withdrawal limits?

You can find your current Chime Spending Account and withdrawal limits by using the chat feature in your Chime mobile app, or by going to Settings > Account Policies & Terms > Deposit Account Agreement in order to view your current account limits.

How Long Does It Take For Chime Mobile Check Deposit

Can I still get my refund if my transactions are turned off?

Yes! Disabling transactions only works for Chime Visa® Debit Card transactions and does not affect tax refunds³ or direct deposits.

Can I deposit my refund check with Mobile Check Deposit?

Sometimes. Unfortunately, we cannot currently guarantee that our Mobile Check Deposit feature will accept all tax refund checks³ due to their unique shape, color, and markings.

Learn more about Mobile Check Deposit limits in your Deposit Account Agreementhere. Please view the back of your debit card to identify your issuing bank.

How do I deposit my tax refund to my Chime account?

Direct deposit is the easiest way to deposit your tax refund into your Chime Spending Account. Whether you file online or on paper, all you need to do is enter your Chime Spending Account Number and Routing Number where prompted.

You can find your Spending Account Number and Routing Number in the Chime app! Just go to Settings > Account Information!

Will I get my tax refund up to two (2) days early?

We can’t guarantee that your tax refund will deposit earlier than the estimated date provided by the IRS. That said, we’ll always post your tax refund to your account as soon as we receive it!

Yes, however a tax refund may only be direct deposited into an account that is in your name. To accept a joint refund, just make sure the name of the primary filer listed on your tax refund is the exact same name listed on the Chime Spending Account you are depositing to.

Important: If the primary filers name doesn’t match the name on the Chime Spending Account it is being deposited, the deposit will be rejected and returned to the IRS. No more than three electronic refunds can be deposited into a single financial account or prepaid card. If you exceed this limit, you will receive a notice from the IRS and a paper check refund.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

We’ll always post your tax refund to your account as soon as we receive it. If you don’t see your tax refund yet, that means we haven’t received it, and our Member Services team won’t have any further information about when it will become available.

The best way to find your estimated refund date is to visit Where’s My Refund on the IRS.gov website or the IRS2Go mobile app. If your expected refund date has passed, we recommend contacting the IRS for more information.

Note: State and Federal Tax Returns are processed on different timelines, and may post to your account on different days.

Can you increase my spending and withdrawal limits?

No. Our spending and withdrawal limits are controlled by our holding bank and cannot be changed at this time.

If I lost my card, will I still get my tax refund?

Yes! Your tax return is deposited using your Chime Spending Account number and Routing number. These do not change when you order a new card.

To make purchases larger than your daily spending limit on your Chime Visa® Debit Card, you can set up direct debit payments with billers who offer this option. You’ll just need to provide the merchant with your Spending Account Number and Routing Number.

Direct debits will be removed from your Chime Spending Account when requested by a biller and do not place any hold on your funds. If your balance is not sufficient to cover the payment, it will be declined.

Note: There are no limits or fees associated with direct debits.

Tax Basics

What if I owe money on my taxes this year due to Unemployment?

It’s possible your tax implications may have changed due to COVID and Unemployment. We recommend speaking with a tax professional and checking theIRS website for more information.

Will I have to pay taxes on the Stimulus Payments?

The IRS has statedthat the Economic Impact Payment (aka Stimulus Payment) will not reduce your refund or increase the amount you owe when you file your 2020 Federal income tax return. For the most updated Tax information, please check theIRS website.

What if I still haven’t received my Economic Impact Payment?

Chime Mobile Check Deposit Time Card

If you did not receive a Stimulus Payment for which you are eligible, you may be eligible for the Recovery Rebate Credit. Please check theIRS website for more information.

Chime Mobile Check Deposit Timeline

What if I need to file for a tax deadline extension?

According to the IRS, if you need more time to prepare and file your taxes, you may be able to file for an extension before the April 15th deadline. We recommend speaking with a tax professional and checking theIRS website for more information.

Alternative: Need more time to prepare your federal tax return? Please check this IRSwebsite which provides information on how to apply for an extension of time to file.

The last day to file your taxes without a penalty is Thursday, April 15th, 2021. To learn more about filing taxes, we recommend speaking with a tax professional and checking theIRS website.

Why should I select direct deposit as my refund method?

Eight out of ten taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

According to the Internal Revenue Service (IRS), “Combining direct deposit with IRS e-File is the fastest way to receive your refund. IRS issues more than9 out of 10 refunds in less than 21 days. You can track your refund using the IRS’s ‘Where’s My Refund‘* tool.” To find out more, readthis article updated on December 4, 2020.

We will notify you as soon as we have received your refund – with an email and a push notification (if enabled on your mobile device)!

What happens if I made a mistake while filing my taxes?

If your tax refund has not yet been sent, you can call the IRS to stop it. Their toll-free number is 1-800-829-1040.

My refund is less than it should be. What should I do?

If your tax refund is less than you were expecting, we recommend contacting the IRS. If you have the Save When I Get Paid feature enabled, 10% of your tax refund will be deposited automatically into your Chime Savings Account.

Your tax refund may be returned if:

- You filed your tax refund under a different name than the one you have on your Chime Spending Account.

- You attempted to deposit someone else’s tax refund into your Chime Account.

- You accidentally used the wrong account number or routing number when you filed.

The most common reason that tax refunds and direct deposits are returned is because the name on the direct deposit doesnotmatch the name on the Chime Account.

If you recently got married or changed your name, contact Chime Member Services to update the name on your Chime Spending Account to match the name on your tax return. You’ll need your updated ID and marriage certificate for verification.

If the name on the direct deposit does not match the name on the Chime Account, the deposit will be returned to the IRS.

If my tax refund was returned, how do I get it now?

Chime Mobile Check Deposit Cutoff Time

Any tax refund that is returned to the IRS will be sent out as a physical check to the address you listed when you filed your taxes. Please reach out to the IRS directly if your refund was returned.