Capitec Fixed Deposit

Posted : admin On 4/8/2022Capitec Bank Deposit Fees

No one likes paying bank fees, so we do what we can to keep ours as low as possible. And we don’t do hidden costs. Ever! The fees below are effective as of 1 April 2018.

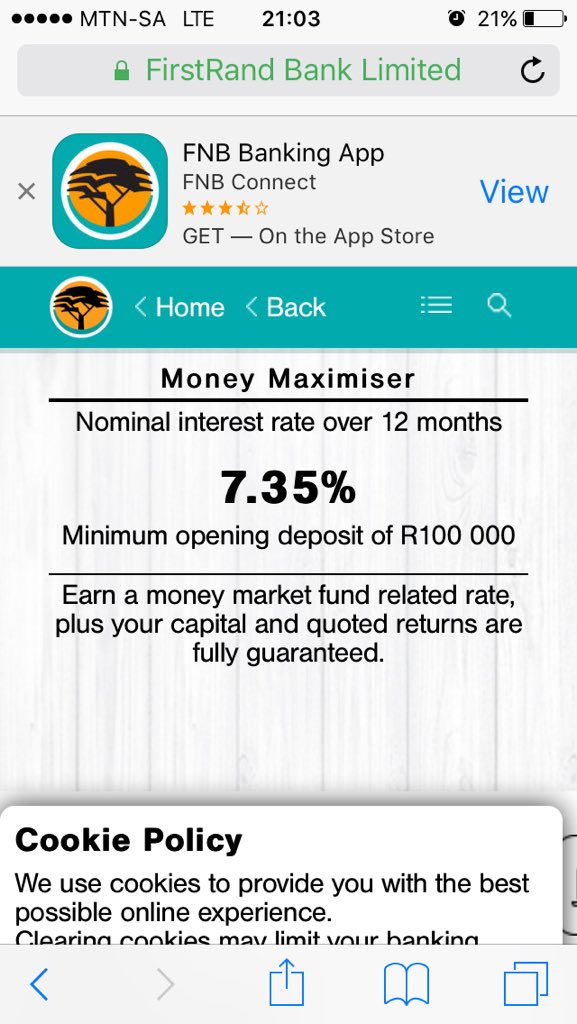

Best Fixed Deposit Rates for February 2021. Best 12 Month Rates for individuals younger than 55. rates last updated 26th February. Fixed-Term Savings plan (single deposit option) Invest for 6 – 60 months, R20 million maximum investment with a minimum deposit of R10 000. You choose how long you want to invest (6 – 60 months) Deposit a single amount up to a maximum of R20 million to invest over the term you choose; Minimum deposit amount of R10 000. Capitec is also the only bank covered by Solidarity in this segment paying interest on accounts in this category, offering an interest rate of 2.25% per annum on a positive balance. Find SAs best fixed deposit rates 🚀. FedGroup's misleading 11.3% 'Effective' Rate 😡😡😡 FedGroup has got some of the best rates in the country. Capitec Savings Account Flexible Savings Features: You can earn from 4.5% interest per year on daily balances. You can choose your deposit amount and the frequency of your deposits. You can choose a name for your plan. You have access your plan any time through Remote Banking or our ATMs. There are no monthly admin fees or minimum balance.

Deposits

Salary cheque FREE

Non-salary cheque 40.35

Cash for loan repayment FREE

Notes (cash-accepting ATM) 96c per R100

Notes/Coins (branch2) R2.27 per R100

Special clearance cheque 100.88

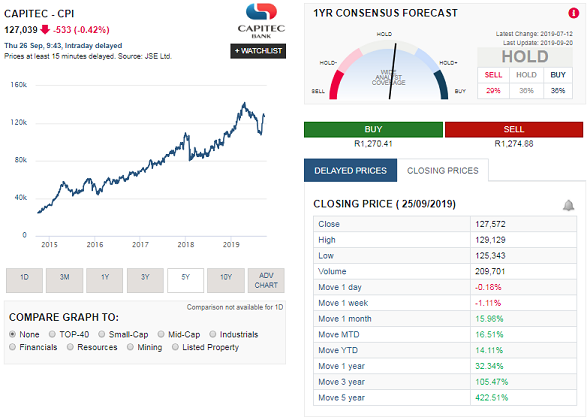

Capitec Fixed Deposit Rates 2020

Returned cheque deposi t131.14

Incoming international payment in rand (fixed fee)5 100.88

Capitec Fixed Deposit Investments

Incoming international payment in foreign currency5 100.88